Set yourself up getting property achievements

The good news is, you will find several simple guidelines you can follow when family bing search and you may applying for a home loan that will set you on the road to triumph.

Once you learn what to expect - and the ways to avoid well-known property errors - you can give yourself the best possible attempt at the rating the fresh new house you desire. This is what to-do.

If you find yourself preparing to score a mortgage and buy a separate home, it is critical to my site tidy up your very own cash and provide on your own since the a powerful credit applicant.

Additionally, it setting avoiding common economic mistakes that can lower your credit energy - if you don't, into the a worst-situation circumstance, enable you to get refuted to own home financing.

Extremely customers are so preoccupied that have simply preserving up for good downpayment and obtaining the base on the home which they neglect the absolutely nothing details that can trip your upwards - such as for instance a decreased credit score and paying down its financial obligation, claims Michele Harrington, COO regarding First Cluster A residential property.

Aren't getting very swept up for the preserving and you can domestic query one you skip most other facts one perception your own home loan.

It is easy getting a house consumer while making errors in this techniques since this transaction is one of the most costly things a man commonly take part in during their life, states Washington.

To purchase a property entails a variety of items happening at the same time. Discover house status facts, mortgage funding products, bargain negotiation products, and you will appraisal problems that is also every create problems, disturb your, and you will end up in problems in the wisdom if you aren't cautious, the guy warnings.

seven Stuff you must not would before buying a property

Below are a few really popular mistakes earliest-big date home buyers make, as to the reasons they amount, and the ways to prevent them.

1. Do not fund an automible or another huge items prior to purchasing

Jim Roberts, chairman regarding Correct North Financial, claims the most significant error customers makes will be to finance a car before making an application for a mortgage loan.

Similarly bothersome is when people need to go out and pick the seats and you may appliances towards the borrowing from the bank in advance of their new home loan shuts, the guy explains.

Many of these affairs are a huge no-zero, since lenders does a final credit query evaluate just before closing; when the new costs were extra, it may jeopardize the mortgage acceptance.

Taking out financing to your a motor vehicle or investment a big-violation item including a boat, relationship, otherwise trips increases your debt-to-earnings proportion (DTI), leading you to seem like a smaller glamorous borrower to help you a lender.

When your DTI try more than a particular tolerance - normally as much as 43% - then you're sensed a dangerous debtor, Harrington cautions. Prevent to make people big instructions or money an alternate vehicles having 6 months otherwise per year before you can need it an excellent house.

dos. Cannot max aside credit debt

Maxing aside a charge card is among the poor something you are able to do before closing towards home financing.

The additional debt percentage matter commonly counterbalance your earnings and you may results inside you qualifying for less home loan capital, Arizona claims. It will likewise reduce your credit history, that will improve the price of the loan.

Roberts cards one to, on the credit scoring system, the true debt total amount does not matter - you could owe $dos,000 or $20,000.

For many who are obligated to pay $2,000 as well as your restriction with the card try $dos,five hundred, your card is virtually maxed out and it'll cause dramatically reduced credit scores - resulting in large prices and you can monthly payments with respect to bringing a loan, he shows you.

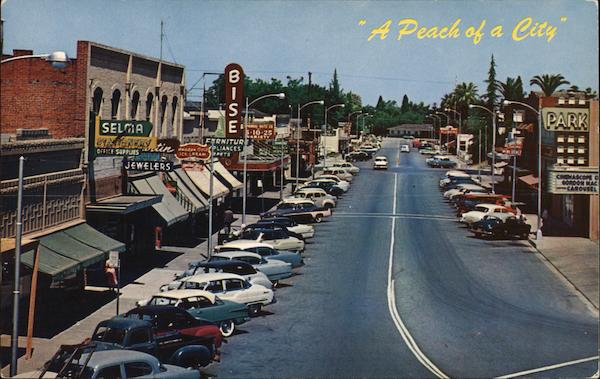

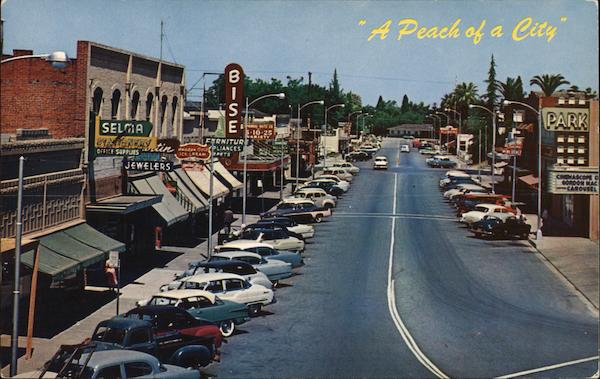

DISH OF THE DAY

Set yourself up getting property achievements

The good news is, you will find several simple guidelines you can follow when family bing search and you may applying for a home loan that will set you on the road to triumph.

Once you learn what to expect – and the ways to avoid well-known property errors – you can give yourself the best possible attempt at the rating the fresh new house you desire. This is what to-do.

If you find yourself preparing to score a mortgage and buy a separate home, it is critical to my site tidy up your very own cash and provide on your own since the a powerful credit applicant.

Additionally, it setting avoiding common economic mistakes that can lower your credit energy – if you don’t, into the a worst-situation circumstance, enable you to get refuted to own home financing.

Extremely customers are so preoccupied that have simply preserving up for good downpayment and obtaining the base on the home which they neglect the absolutely nothing details that can trip your upwards – such as for instance a decreased credit score and paying down its financial obligation, claims Michele Harrington, COO regarding First Cluster A residential property.

Aren’t getting very swept up for the preserving and you can domestic query one you skip most other facts one perception your own home loan.

It is easy getting a house consumer while making errors in this techniques since this transaction is one of the most costly things a man commonly take part in during their life, states Washington.

To purchase a property entails a variety of items happening at the same time. Discover house status facts, mortgage funding products, bargain negotiation products, and you will appraisal problems that is also every create problems, disturb your, and you will end up in problems in the wisdom if you aren’t cautious, the guy warnings.

seven Stuff you must not would before buying a property

Below are a few really popular mistakes earliest-big date home buyers make, as to the reasons they amount, and the ways to prevent them.

1. Do not fund an automible or another huge items prior to purchasing

Jim Roberts, chairman regarding Correct North Financial, claims the most significant error customers makes will be to finance a car before making an application for a mortgage loan.

Similarly bothersome is when people need to go out and pick the seats and you may appliances towards the borrowing from the bank in advance of their new home loan shuts, the guy explains.

Many of these affairs are a huge no-zero, since lenders does a final credit query evaluate just before closing; when the new costs were extra, it may jeopardize the mortgage acceptance.

Taking out financing to your a motor vehicle or investment a big-violation item including a boat, relationship, otherwise trips increases your debt-to-earnings proportion (DTI), leading you to seem like a smaller glamorous borrower to help you a lender.

When your DTI try more than a particular tolerance – normally as much as 43% – then you’re sensed a dangerous debtor, Harrington cautions. Prevent to make people big instructions or money an alternate vehicles having 6 months otherwise per year before you can need it an excellent house.

dos. Cannot max aside credit debt

Maxing aside a charge card is among the poor something you are able to do before closing towards home financing.

The additional debt percentage matter commonly counterbalance your earnings and you may results inside you qualifying for less home loan capital, Arizona claims. It will likewise reduce your credit history, that will improve the price of the loan.

Roberts cards one to, on the credit scoring system, the true debt total amount does not matter – you could owe $dos,000 or $20,000.

For many who are obligated to pay $2,000 as well as your restriction with the card try $dos,five hundred, your card is virtually maxed out and it’ll cause dramatically reduced credit scores – resulting in large prices and you can monthly payments with respect to bringing a loan, he shows you.