Some of the can cost you you will spend in the closure include tape fees, label insurance policies, and condition financial taxation. Since the rates of these will cost you tend to differ and change over the years, you need to consult a lender for the most exact quantity.

Settlement costs would be very changeable, mainly dependent on in your geographical area, the prerequisites to suit your loan, together with value of your home

This type of costs are set in the loan balance with the a monthly foundation. Mainly because prices are mainly dependent on the level of the loan balance and exactly how a lot of time you keep the loan, the way to stop all of them is to try to acquire merely due to the fact loans Citronelle very much like you need.

Attract Let's begin by the obvious constant prices with the one mortgage-the eye. Identical to a traditional forward mortgage, notice towards the an opposing financial are billed that is set in the mortgage equilibrium. If you're a forward mortgage needs month-to-month notice and you can dominating payments by this new debtor up until the financing is actually paid back, the alternative happens with an opposing mortgage. Much like its identity suggests, a contrary mortgage allows this new debtor to get money and do not want that generate attract or dominating costs through to the financing gets due and payable. But not, when you are zero monthly mortgage payments are required to your an opposing mortgage, you've got the freedom to pay only a small amount otherwise normally as you would like, as frequently because the you'd like.

When it comes to contrary mortgage rates, you may have one or two solutions-possibly a predetermined rate otherwise a changeable rate. When you are a fixed-price contrary financial boasts a reliable interest, you are required to located the loan proceeds in one single lump share, rather than monthly profits. However, it is well worth detailing this particular lump sum payment is actually less matter of the overall readily available continues. Instead, a changeable-speed home loan comes with a fluctuating speed, susceptible to change both month-to-month or a year. Using this alternative, you are entitled to numerous delivery actions, including lump sum, month-to-month profits, and you may a line of credit. Therefore, an adjustable price will demand you to pay only attention to the the amount of finance you taken.

While every and each of them choices possess advantages, it is important to speak with your financial from the hence choice may work most effectively for your individual condition.

Servicing Costs A special regular ongoing mortgage costs was a lender repair fee. Generally speaking $thirty five or smaller four weeks, which payment is paid down to the financial to fund will cost you associated with giving account statements, distributing fund, monitoring fees and insurance coverage, and you may bringing most other loan characteristics.

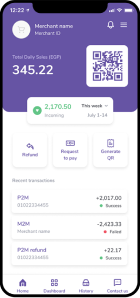

At the Longbridge Monetary , we believe exceptional solution doesn't have ahead that have a percentage. That's why we really do not costs all of our HECM borrowers maintenance charges. All of our mission will be to leave you high provider-and you will peace of mind about your money. In addition, we make you 24/7/365 the means to access your bank account information through our very own online webpage, as well as on the web statements. And we are the sole productive financial and you will servicer with a cellular software for ios and you may Android os gizmos. Find out more about Longbridge's servicing agency right here .

Settlement costs Ah, this new inevitable settlement costs-regardless of the sorts of financing you're interested in, you will likely need certainly to kepted money to cover these types of fees

Annual Financial Cost (MIP) As previously mentioned, your home loan insurance policies discusses specific ensures. Since initial mortgage advanced (MIP) is paid off at the time of closure, you will also have to pay a yearly financial premium more the life span of the loan equivalent to 0.5% of a great financial balance. Home loan insurance premium prices are put in your own contrary home mortgage harmony monthly, that will accrue attract on the longevity of the loan.

DISH OF THE DAY

Some of the can cost you you will spend in the closure include tape fees, label insurance policies, and condition financial taxation. Since the rates of these will cost you tend to differ and change over the years, you need to consult a lender for the most exact quantity.

Settlement costs would be very changeable, mainly dependent on in your geographical area, the prerequisites to suit your loan, together with value of your home

This type of costs are set in the loan balance with the a monthly foundation. Mainly because prices are mainly dependent on the level of the loan balance and exactly how a lot of time you keep the loan, the way to stop all of them is to try to acquire merely due to the fact loans Citronelle very much like you need.

Attract Let’s begin by the obvious constant prices with the one mortgage-the eye. Identical to a traditional forward mortgage, notice towards the an opposing financial are billed that is set in the mortgage equilibrium. If you’re a forward mortgage needs month-to-month notice and you can dominating payments by this new debtor up until the financing is actually paid back, the alternative happens with an opposing mortgage. Much like its identity suggests, a contrary mortgage allows this new debtor to get money and do not want that generate attract or dominating costs through to the financing gets due and payable. But not, when you are zero monthly mortgage payments are required to your an opposing mortgage, you’ve got the freedom to pay only a small amount otherwise normally as you would like, as frequently because the you’d like.

When it comes to contrary mortgage rates, you may have one or two solutions-possibly a predetermined rate otherwise a changeable rate. When you are a fixed-price contrary financial boasts a reliable interest, you are required to located the loan proceeds in one single lump share, rather than monthly profits. However, it is well worth detailing this particular lump sum payment is actually less matter of the overall readily available continues. Instead, a changeable-speed home loan comes with a fluctuating speed, susceptible to change both month-to-month or a year. Using this alternative, you are entitled to numerous delivery actions, including lump sum, month-to-month profits, and you may a line of credit. Therefore, an adjustable price will demand you to pay only attention to the the amount of finance you taken.

While every and each of them choices possess advantages, it is important to speak with your financial from the hence choice may work most effectively for your individual condition.

Servicing Costs A special regular ongoing mortgage costs was a lender repair fee. Generally speaking $thirty five or smaller four weeks, which payment is paid down to the financial to fund will cost you associated with giving account statements, distributing fund, monitoring fees and insurance coverage, and you may bringing most other loan characteristics.

At the Longbridge Monetary , we believe exceptional solution doesn’t have ahead that have a percentage. That’s why we really do not costs all of our HECM borrowers maintenance charges. All of our mission will be to leave you high provider-and you will peace of mind about your money. In addition, we make you 24/7/365 the means to access your bank account information through our very own online webpage, as well as on the web statements. And we are the sole productive financial and you will servicer with a cellular software for ios and you may Android os gizmos. Find out more about Longbridge’s servicing agency right here .

Settlement costs Ah, this new inevitable settlement costs-regardless of the sorts of financing you’re interested in, you will likely need certainly to kepted money to cover these types of fees

Annual Financial Cost (MIP) As previously mentioned, your home loan insurance policies discusses specific ensures. Since initial mortgage advanced (MIP) is paid off at the time of closure, you will also have to pay a yearly financial premium more the life span of the loan equivalent to 0.5% of a great financial balance. Home loan insurance premium prices are put in your own contrary home mortgage harmony monthly, that will accrue attract on the longevity of the loan.